Is China still investable from an ESG perspective, and why does this matter for your portfolio returns?

TT International (distributed by Copia Investment Partners)

China has been front and centre of investors’ minds in recent months, with much ink spilled on the bull case now that the world’s second-largest economy has reopened. Far less attention has been focused on investing in China from an ESG perspective. Only a few months ago there was a sharp sell-off in Chinese equities after President Xi cemented his grip on power, heightening concerns about the country’s governance, and leading some analysts to question whether China was even investable. Meanwhile, although Xi has built a reputation for prioritising the environment, it has been made clear in recent weeks that China’s climate targets cannot compromise the country’s short-term economic growth or energy security, raising concerns that China’s environmental credentials could be undermined. In the piece below consideration is given to investing in China from an ESG perspective following the dramatic developments of recent months. Such analysis is important for almost any investor looking to make strong returns, as in order to do so it is crucial to understand the ESG backdrop as well as the resultant risks and opportunities.

From an environmental perspective, whilst China has pivoted towards a strategy of prioritising economic growth and energy security, the country remains uniquely relevant to the energy transition on a number of levels:

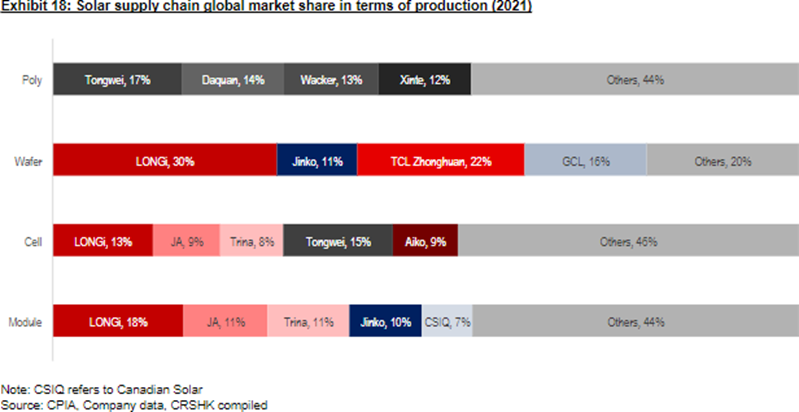

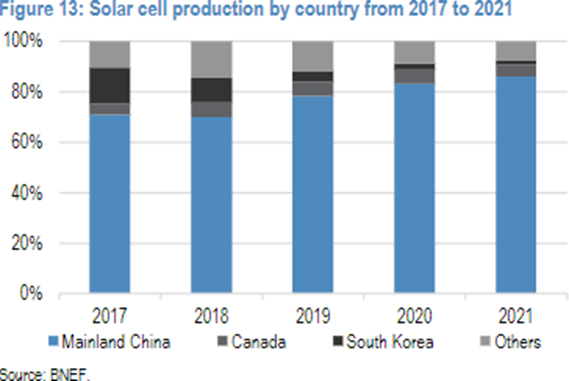

1.Production. China dominates all facets of the global solar supply chain. As seen in the chart below, the largest players in every stage of the module manufacturing process (including stages not shown such as solar glass) are Chinese. Indeed, most of the production coming from ‘Others’ is from second- and third-tier Chinese players. Furthermore, while measures such as the Inflation Reduction Act will bring capacity to the US, China has been increasing its aggregate share of global production (see second chart below) over the last few years due to its significant cost advantage.

China’s wind equipment manufacturers have fared less well overseas than its solar producers. That said, the sheer size of the Chinese domestic market makes them globally relevant players, with companies such as MingYang likely to rival the likes of Vestas in scale over the next few years. There is also increasing evidence of Chinese companies achieving international success in emerging markets and for emergent technologies (e.g. floating offshore wind farms) that the European Original Equipment Manufacturers (OEMs) are reluctant to bid on.

Within EV, China faces stiff competition from Korean EV battery makers (LG, Samsung, SK) and their respective supply chains, as well as Panasonic and its Japanese suppliers. That said, Chinese battery manufacturer CATL has a ~30% share in global Electric Vehicle (EV) and Energy Storage System (ESS) battery production (and boasts an even higher market share within EV batteries), while smaller cell manufacturers such as EVE have relevant global shares due to the sheer size of the domestic market. Although the battery materials market has tended to be home-biased (e.g. Korean cell makers preferring Korean components), certain Chinese companies have achieved such significant cost leadership that they have become important suppliers to overseas customers. For example, Yunnan Energy has captured over 50% of the global separator market.

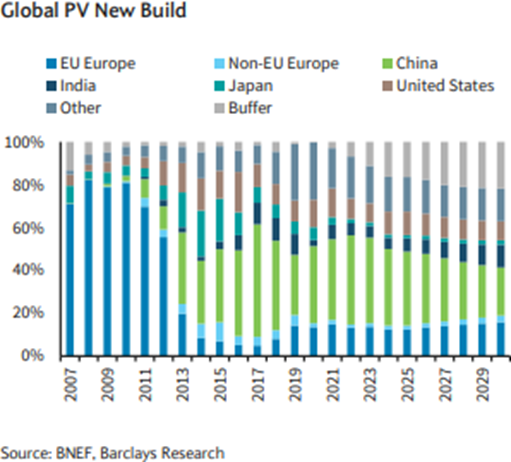

2. Deployment. In renewable energy (both solar and wind) as well as EVs, China is outstripping the world in the pace of its deployment of these technologies. As seen in the chart below, China has represented ~40% of global solar deployment over the last few years.

Moreover, because the pace of deployment has significantly accelerated over this period, China’s overall share of installed capacity is similar, despite it being relatively late to start taking share. China is likely to continue to add solar capacity at >100 Gigawatts (GW) p.a. (global deployment in 2022 was ~230GW). The National Energy Administration said the aim is to reach 430GW of wind and 490GW of solar power by year-end in its roadmap released in January 2023. That would be 118GW of new solar capacity over end-November levels, and an additional 79GW of wind.

In wind, China tendered over 100GW of projects in 2022. For context Bloomberg New Energy Finance (BNEF) estimates a total global onshore market of ~90-95GW p.a. from 2023-25, and an offshore market of ~15-25GW p.a., with the US not installing more than mid-teens GW p.a. over this period. The scale of Chinese tendering activity in 2022 means that global numbers will have to be revised higher. China will likely have as much, if not more, global market share of wind installations as solar over the coming years.

Meanwhile, about 10m EVs were sold globally in 2022, of which ~6m were sold in China alone; Chinese EV penetration rates are ~30% of new vehicles sold versus 7% in the US and just over 20% for Europe.

3. Innovation. Chinese companies have proven themselves to be at the forefront of innovation, either by developing new technologies or by aggressively scaling them. In EV, China has a leadership position and has been the locus for innovations such as lithium iron phosphate batteries (CATL), Blade Battery (BYD), and sodium-ion batteries (CATL). EV OEMs have aggressively innovated in areas such as Advanced Driver-Assistance Systems (ADAS) and battery swapping to maintain competitiveness against Tesla within their domestic market. In solar, the industry is currently transforming as Passivated Emitter and Rear Contact (PERC) standard cells are being replaced by three new higher efficiency technologies (Heterojunction technology, Tunnel Oxide Passivated Contact, and Hybrid Passivated Back Contact.) Whilst these technologies are being developed elsewhere in the world, only in China are companies ramping up production at the scale required. It is also worth noting that several large Chinese solar companies are incubating electrolyser start-ups as they seek to gain leadership in new technologies. Whilst wind OEMs have tended to be more incremental from an innovation perspective (gradually improving the size of turbines), Chinese companies have shown a willingness to bid for international projects in novel technologies such as floating offshore, which have proven to not be of commercial interest to the Big-3 players.

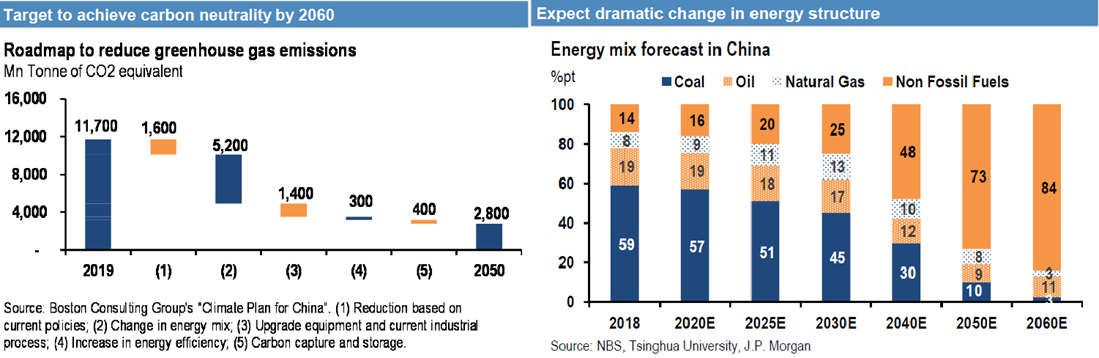

4. Opportunity. Finally, to disallow China from investment would be to miss out on the biggest opportunity the world has to decarbonise power and industry. At the end of 2021, China had approximately 1.1 Terawatts (TW) of coal capacity – more than 50% of global capacity. While roughly one-third of global power production in 2021 was coal-fired, in China it was more than 60%. Somewhat unsurprisingly, China accounts for a third of global emissions. When measured at a country level, China represents the single largest global opportunity to address climate change.

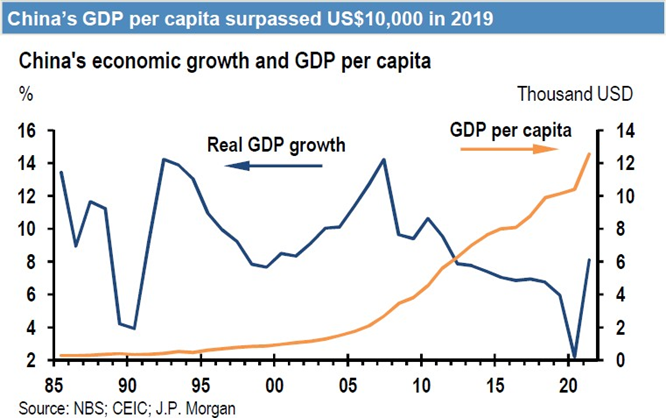

From a social perspective, investor concerns about human rights are an area that Chinese companies have to address. However, it is also important to remember the great strides made in improving the lives of countless people. When Deng Xiaoping became China’s pre-eminent leader in 1978, his bold reforms sowed the seeds of a socioeconomic miracle. Over forty years later, and after sustained economic growth averaging 9% per annum, more than 800 million Chinese people have been lifted out of poverty.

Throughout human history, no other country has ever dragged as many people out of extreme poverty within such a short period of time. For all the known shortcomings of China’s governance model, the country’s socioeconomic rise has been undeniably meteoric. Following its eradication of absolute poverty, China has set the year 2035 as the target date to achieve “common prosperity.” This is generally understood to mean providing the opportunity for a decent standard of living to all 1.4 billion Chinese citizens – almost one-fifth of the world’s human population. It goes without saying that sustained economic growth will once again be the key mechanism through which this goal is achieved. By investing in China, asset allocators are helping to drive this growth, and as living standards rise, Chinese people will also increase their expectations for stable governance from their leaders.

Sticking with governance, the recent Communist Party Congress was a watershed moment, and the fact that President Xi tightened his grip on power is an unequivocal negative in our view. All newly appointed members of the Politburo Standing Committee are committed Xi loyalists. This composition makes for the most uniform Politburo of the last four decades, with all members owing their political accession to Xi. As a result, the country is now effectively under one-man rule. By removing all dissenting voices, China has no balance of power within its governance systems, resulting in increasing unpredictability, and a growing risk of policy errors from an economic, geopolitical and indeed ESG perspective. However, there are some nuances that are important to elucidate for investors.

China’s leaders are acutely aware of their implicit social contract with the people, namely that the party will deliver increasing prosperity in exchange for popular support of its rule. For this reason and others, China’s political and regulatory cycles tend to run countercyclical to the economic cycle. That is to say, the intensity of repression and regulation increases when the country’s financial position is strong, whilst a weak economy tends to prompt a relaxation and easing of regulation. As it stands, there is immense fiscal pressure on both local- and state-level budgets, given the self-inflicted contraction of the real estate sector. The Chinese government’s regulatory crackdown on internet, retail, and fintech platforms that began in 2021 was also extremely detrimental to the equity market’s performance, which is a key source of wealth for the Chinese population. It appears we are in the midst of a policy reset that will focus on growth as opposed to regulation. This will have important ramifications for private businesses and minority shareholders in China.

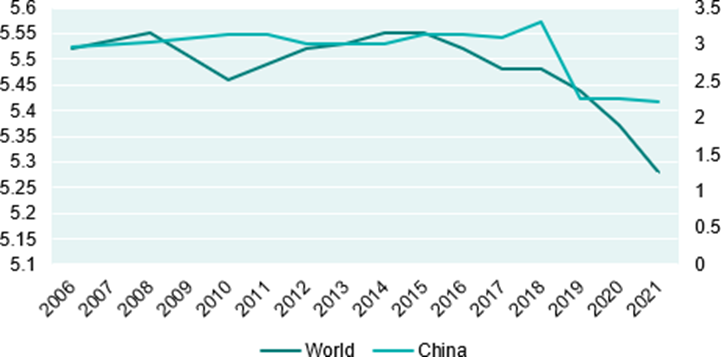

To help visualise this concept, it is useful to examine the Democracy Index compiled annually by the EIU. This uses a weighted score based on 60 questions about a given country’s freedoms and level of democratic participation. Perhaps unsurprisingly, China has been consistently authoritarian according to this metric. There was a notable deterioration in 2018/2019, when regulation was tightened for various privately-owned enterprises and the real estate sector in particular. This was during a period when the economy and stock market were thriving, especially compared to 2015/2016, when China narrowly avoided an economic crisis due to a stock market crash and run on the currency. With the Chinese economy and stock market having been hit hard in 2022 by covid and tight government regulations, the Democracy Index is likely to improve in 2023/2024. Such developments should reduce the implied governance risk premium for Chinese equities, helping to drive a re-rating. As an aside, it is worth noting that the overall Democracy Index has fallen in recent years, mainly due to the appointments of political ‘strongmen’ around the world. Emerging market investors would find it almost impossible to allocate capital solely to stable democracies whilst maintaining a reasonable degree of diversification.

Finally at a corporate level, the experience on the ground suggests that governance is improving. There have been marked enhancements in board-level independence at Chinese companies, including at the audit committees, which are crucial for reducing audit risks for investors. Perhaps surprisingly, the biannual Asian Corporate Governance Association Corporate Governance Watch published in May 2021 found that China now scores slightly higher than the Asian average in board independence. This is a phenomenon that has been observed in TT's investee companies, with Alibaba’s board-level independence improving consistently since 2020 and reaching a majority in 2022.

Meanwhile, company disclosure is also improving. For example, an increasing number of companies are reporting their greenhouse gas emissions, despite this not being required by the regulators. While Chinese companies are at a deficit to other emerging markets in terms of their external ESG ratings, advances in ESG disclosure can improve companies’ investability, and indeed the positive rate of change is more likely to generate alpha for investors than simply buying companies with high ESG ratings. Finally, TT has found our investee companies significantly more willing to engage on ESG issues and controversies than expected.

Those familiar with TT will know that the investment process integrates top-down and bottom-up research, with the bottom-up analysis following a rigorous VVC-ESG approach, where the Valuation case for every investment is considered, Verify assumptions using a wide range of sources, identify clear Catalysts to realise the outperformance, and make an assessment of ESG issues. There have been a number of positive developments in China from both a top-down and bottom-up perspective in recent months. These range from economic reopening and the property sector effectively being underpinning by the government, to the receding risk of mass ADR de-listings and improving earnings expectations for many of China’s largest companies, most notably its internet giants that have implemented large cost-cutting programmes. The economic case for overweight exposure to China in TT's EM portfolios would therefore seem to be strong. As the analysis above shows, although there are always important ESG questions to ask when allocating capital to China, particularly given the increasing concentration of power, the country remains one of the key investment opportunities to enable a successful global transition to a green economy and improve the lives of hundreds of millions of people.

This information has been prepared by Copia Investment Partners Limited (AFSL 229316 , ABN 22 092 872 056) the issuer, distributor and responsible entity of the TT Global Environmental Impact Fund. This website provides information to help investors and their advisers assess the merits of investing in financial products. We strongly advise investors and their advisers to read information memoranda and product disclosure statements carefully and seek advice from qualified professionals where necessary. The information in this document does not constitute personal advice and does not take into account your personal objectives, financial situation or needs. It is therefore important that if you are considering investing in any financial products and services referred to in this document, you determine whether the relevant investment is suitable for your objectives, financial situation or needs. You should also consider seeking independent advice, particularly on taxation, retirement planning and investment risk tolerance from a suitably qualified professional before making an investment decision. Neither Copia Investment Partners Limited, nor any of our associates, guarantee or underwrite the success of any investments, the achievement of investment objectives, the payment of particular rates of return on investments or the repayment of capital. Copia Investment Partners Limited publishes information on the document that is, to the best of its knowledge, current at the time and Copia is not liable for any direct or indirect losses attributable to omissions from the document, information being out of date, inaccurate, incomplete or deficient in any other way. Investors and their advisers should make their own enquiries before making investment decisions.

The TT Global Environmental Impact Fund invests all or substantially all of its assets in TT Environmental Solutions Fund, a sub-fund of TT International Funds plc. TT International Asset Management Ltd (“TT International”) serves as investment manager to the Fund and is authorised and regulated in the United Kingdom by the Financial Conduct Authority. TT International is not affiliated with Copia Investment Partners. TT International does not take any responsibility for the accuracy or completeness of any information contained herein, or the performance of the TT Global Environmental Impact Fund offered by Copia Investment Partners. TT International disclaims any liability for any direct, indirect, consequential or other losses or damages, including loss of profits, incurred by you or by any third party that may arise from any reliance on these materials. TT International is not responsible for, nor involved in, the marketing, distribution or sales of shares or interests in the TT Global Environmental Impact Fund and is not responsible for compliance with any marketing or promotion laws, rules or regulations. No statement in this document is or should be construed as investment, legal, or tax advice given by TT International, nor is any statement an offer to sell, or a solicitation of an offer to buy, any security or other instrument, or an offer to arrange any transaction, or to enter into legal relations with TT International. Past performance by any other funds or accounts advised by TT International, including the TT Environmental Solutions Fund, is not indicative of any future performance by the TT Global Environmental Impact Fund.