Waste not, Warm not

Regnan

Waste management is a cornerstone of sustainable development with a multiplier effect on public health, safety and environmental outcomes. But it’s also perceived as being a dirty business; and is often thought of as having a high carbon footprint. In this report, Regnan’s experts in water and waste and climate change provide answers to the questions:

- Where do greenhouse gas emissions arise along the waste management life cycle?

- How are these emissions being managed?

- What are the best ideas emerging in the sector to decarbonise waste management?

- What can investors do to encourage low carbon transition?

Highlights

- Increasing focus on greenhouse gas emissions (GHG) in the waste management value chain presents many options for decarbonisation in the sector.

- Waste collection is an important enabler of reuse, recycling, and composting – key ways waste emissions can be reduced. Fuel efficiency, use of alternative fuels and electric vehicles present options for decarbonisation.

- There are interdependencies between waste management life cycle stages such that activities with low direct emissions rely on high emissions activities elsewhere in the value chain.

- Divestment can only shift high emissions activities out of portfolios, it does nothing to reduce the real-world impact of waste management.

- We see engagement with waste management companies as the best way for investors to contribute to waste decarbonisation.

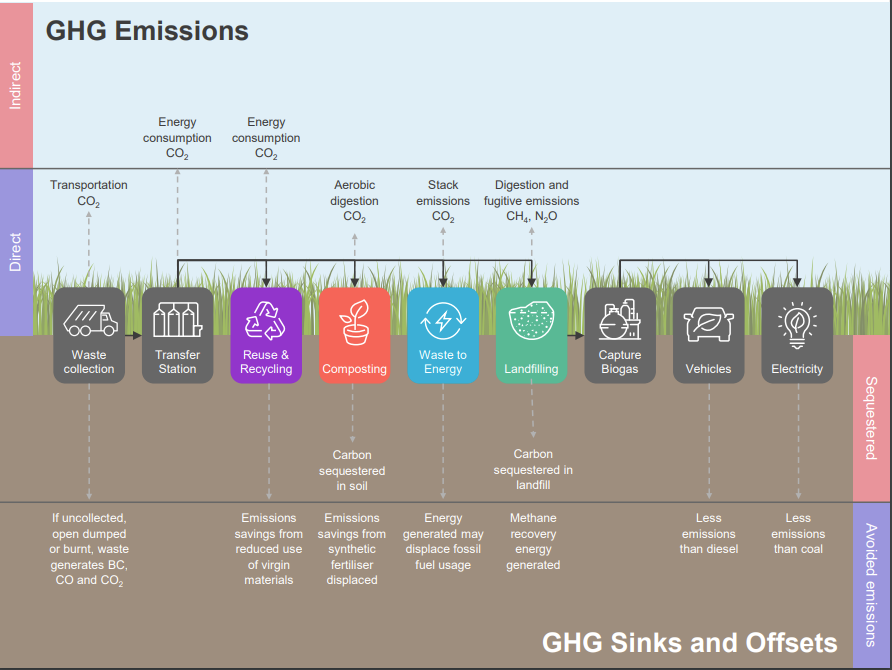

Carbon emissions footprint across the waste life cycle

While the broader sustainability credentials of effective waste management are readily acknowledged, there have been some lingering questions about the carbon footprint of waste management, which contributes about 3.3% of total global emissions, with ~2% from landfills.

Emissions arise throughout the waste management value chain and over different time scales. Waste collection contributes around 6-8% of emissions for an integrated waste management company involved across all life cycle stages. These emissions all occur in the year the collection occurs.

Landfills are the greatest share of the total emissions footprint: ~90% of total emissions for integrated waste management companies.

Landfill emissions are primarily from organic waste breaking down and releasing methane – a greenhouse gas that is ~28 times more potent than carbon dioxide. This is a slow process, with current year emissions arising from waste deposited over many years.

There are interdependencies between waste management life cycle stages such that activities with low direct emissions rely upon high emissions activities elsewhere in the value chain. For example, collection is an important enabler of reuse, recycling, and composting – key ways waste management emissions can be reduced.

Emissions management

Waste collection and sorting

Waste collection and sorting is a critical component in the efficient reduction of GHG emissions in waste management, enabling reuse, recycling, composting, energy recovery and landfilling of waste. It is also essential to meet waste regulatory requirements in many jurisdictions. Emissions can be reduced by:

- Using lower emissions fuels;

- Using software to optimise collection routes; and

- Upgrading trucks to more fuel-efficient models.

Substantial improvements in emissions intensity can be gained with these measures, for example:

- Waste Management Inc. reduced emissions per 1,000 miles driven by 31% from 2010 to 2019.

- Republic Services reduced fleet emissions by 7.5% in 2020 by using renewable natural gas.

Energy recovery

With room to landfill waste running out in some countries, energy recovery from waste incineration is expected to play an increasing role. Incineration of waste under controlled circumstances for the generation of energy has substantial GHG benefits compared to landfills according to the IPCC.

- Biffa diverts 500,000 tonnes of waste which cannot be recycled away from landfills to energy recovery facilities. The facilities will produce 90MW of energy, sufficient to power 170,000 homes in the United Kingdom.

- Clean Harbors’ Safety-Kleen business addresses the priority to maximise reuse before energy recovery, diverting waste lubricant oils that would otherwise be burned for fuel. The company estimates on a life cycle basis that 8 kilograms of GHGs are saved through re-refining one gallon of used motor oil, compared with one gallon of motor oil refined from crude oil.

Reuse and Recycling

Reuse and recycling reduce GHG emissions by saving virgin materials and lowering the energy demand for production. Significant GHG emissions savings arise from composting where synthetic fertiliser is displaced and from recycling for materials that are energy intensive to produce, such as steel, aluminium, and glass.

Companies involved include recycling specialists, such as Copart, LKQ and Schnitzer, and integrated waste management companies, such as Waste Connections, Waste Management Inc., Republic Services, Cleanaway Waste and Biffa.

- Waste Management Inc. is the largest postconsumer recycler in North America avoiding ~27 million MtCO2-e per year.

- Veolia’s PROCYCLE provides a solution for difficult to recycle items such as crisp packets, sweet wrappers and plastic toys utilising in-house expertise and network recyclers.

Landfilling

Improving landfilling processes and technologies offers the most opportunities to reduce GHG emissions, with state-of-the-art operations able to reduce emissions by up to 90%.

The volume of GHG emissions depend on how the site is operated; factors like whether it is an open dump or a controlled landfill, and the existence and type of gas collection system make a big difference.

- Waste Connections has gas collection at 50 sites, from 28 of these sites landfill gas generates electricity, fuels local industrial facilities or fuels vehicles, annually processing 28.5 billion standard cubic feet of gas (equivalent to power 289,000 homes).

- Republic Services Group has 69 landfill gas to energy projects. With beneficial use of biogas at 72.3 billion standard cubic feet, and a target of 110 billion standard cubic feet by 2030.

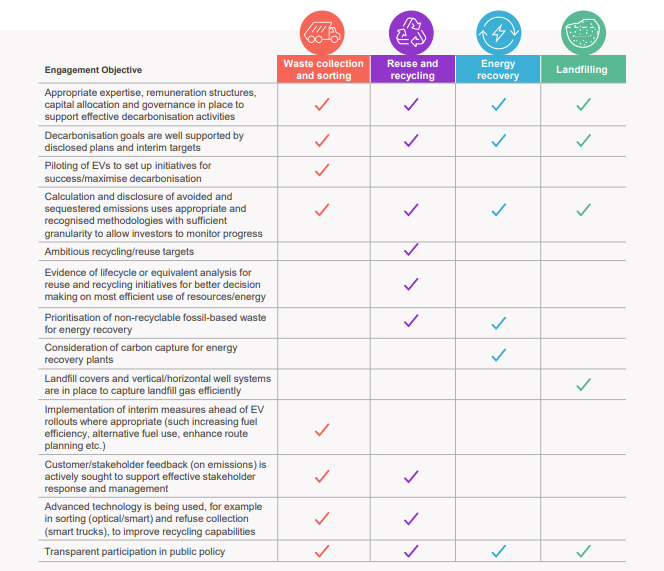

How can investors accelerate decarbonisation of the waste management sector?

Given the interdependencies between waste management life cycle stages – with low emission activities dependent on high emissions activities elsewhere in the value chain – divestment can only shift high emissions activities out of portfolios; it does nothing to reduce the real world impact of waste management.

That’s why we see engagement with waste management companies as the best way investors can contribute to the decarbonisation of the waste sector.

Engagement is a central plank of our active stewardship approach. Our engagements involve investment and subject matter experts from across Regnan. We set objectives for engagement in advance for individual companies, track progress, and transparently report to clients at least annually on the changes observed.

The table below sets out the key priorities we see for engagement with waste management companies on decarbonisation. Applicability will depend on individual company circumstances and performance.

This content is for professional investors only.

Regnan is a standalone responsible investment business division of Pendal Group Limited (Pendal). Pendal is an Australian-listed investment manager and owner of the J O Hambro Capital Management Group. Regnan’s focus is on delivering innovative solutions for sustainable and impact investment, leaning on over 20 years of experience at the frontier of responsible investment. “Regnan” is a registered trademark of Pendal. The Regnan business consists of two distinct business lines. The investment management business is based in the United Kingdom and sits within J O Hambro Capital Management Limited, which is authorised and regulated by the Financial Conduct Authority and is registered as an investment adviser with the SEC. “Regnan” is a registered as a trading name of J O Hambro Capital Management Limited. The investment team manages the Regnan Global Equity Impact Solutions (RGEIS) strategy which aims to generate market-beating long-term returns by investing in solutions to the world’s environmental and societal problems. The RGEIS strategy is distributed in Australia by Pendal Fund Services Limited.

Alongside the investment team is the Regnan Insight and Advisory Centre of Pendal Institutional Limited in Australia, which has a long history of providing engagement and advisory services on environmental, social and governance issues. While the investment management team will often draw on services from and collaborate with the Regnan Insight and Advisory Centre, they remain independent of the Regnan Insight and Advisory Centre and are solely responsible for the investment management of the RGEIS strategy.

Issued and approved in the UK by J O Hambro Capital Management Limited (“JOHCML”) which is authorised and regulated by the Financial Conduct Authority. Registered office: Level 3, 1 St James’s Market, London SW1Y 4AH. J O Hambro Capital Management Limited. Registered in England No:2176004.

Issued in the European Union by JOHCM Funds (Ireland) Limited (“JOHCMI”) which is authorised by the Central Bank of Ireland. Registered office: Riverside One, Sir John Rogerson’s Quay, Dublin 2, Ireland.

Regnan is a trading name of J O Hambro Capital Management Limited.

The registered mark J O Hambro® is owned by Barnham Broom Holdings Limited and is used under licence. JOHCM® is a registered trademark of J O Hambro Capital Management Limited.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

The information in this document does not constitute, or form part of, any offer to sell or issue, or any solicitation of an offer to purchase or subscribe for Funds described in this document; nor shall this document, or any part of it, or the fact of its distribution form the basis of, or be relied on, in connection with any contract.

Recipients of this document who intend to subscribe to any of the Funds are reminded that any such purchase may only be made solely on the basis of the information contained in the final prospectus, which may be different from the information contained in this document. No reliance may be placed for any purpose whatsoever on the information contained in this document or on the completeness, accuracy or fairness thereof

No representation or warranty, express or implied, is made or given by or on behalf of the Firm or its partners or any other person as to the accuracy, completeness or fairness of the information or opinions contained in this document, and no responsibility or liability is accepted for any such information or opinions (but so that nothing in this paragraph shall exclude liability for any representation or warranty made fraudulently).

The distribution of this document in certain jurisdictions may be restricted by law; therefore, persons into whose possession this document comes should inform themselves about and observe any such restrictions. Any such distribution could result in a violation of the law of such jurisdictions.

The information contained in this presentation has been verified by the firm. It is possible that, from time to time, the fund manager may choose to vary self imposed guidelines contained in this presentation in which case some statements may no longer remain valid. We recommend that prospective investors request confirmation of such changes prior to investment. Notwithstanding, all investment restrictions contained in specific fund documentation such as prospectuses, supplements or placement memoranda or addenda thereto may be relied upon.

Investments fluctuate in value and may fall as well as rise and that investors may not get back the value of their original investment.

Past performance is not necessarily a guide to future performance.

Investors should note that there may be no recognised market for investments selected by the Investment Manager and it may, therefore, be difficult to deal in the investments or to obtain reliable information about their value or the extent of the risks to which they are exposed.

The Investment Manager may undertake investments on behalf of the Fund in countries other than the investors’ own domicile. Investors should also note that changes in rates of exchange may cause the value of investments to go up or down.

The information contained herein including any expression of opinion is for information purposes only and is given on the understanding that it is not a recommendation.

Notice to Swiss investors: RBC Investor Services Bank S.A., with registered office at Esch-sur-Alzette, Badenerstrasse 567, P.O. Box 1292. CH-8048 Zurich has been appointed to act both in a capacity as Swiss representative and Swiss paying of the JOHCM Asia ex Japan Fund. All legal documentation pertaining to the JOHCM Asia ex Japan Fund can be obtained free of charge from the Swiss representative. The place of performance and jurisdiction in relation to [shares/units] distributed in Switzerland is at the registered office of the Swiss representative

Information on how JOHCM handles personal data which it receives can be found in the JOHCM Privacy Statement on our website: www.johcm.com